35+ what percent of mortgage to income

Ad 10 Best House Loan Lenders Compared Reviewed. Find A Lender That Offers Great Service.

Why Isn T Anyone Talking About This Realtors Will Always Say It Is The Best Time To Buy Wow The Median House Has Went From 2019 274 600 With Qualifying Income Of 50 592

Web The 28 rule refers to your mortgage-to-income ratio.

. Web Here are some mortgage rule of thumb concepts to help calculate how much you can afford. Web Here are debt-to-income requirements by loan type. Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac.

Find all FHA loan requirements here. Web The Standard Mortgage to Income Ratio Rules. Faster easier mortgage lending Check.

Web This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income and. Web Using a mortgage-to-income ratio no more than 28 of your gross income should go toward your mortgage paymentincluding principal interest tax and insurance. All loan programs have their own maximum debt ratio allowances as follows.

Youll usually need a back-end DTI ratio of 43 or less. Save Real Money Today. Find all FHA loan requirements here.

Web When calculating your household expenses Sethi says to consider everything your mortgage will include. With the 35 45 model your total monthly debt. Web Most lenders recommend that your DTI not exceed 43 of your gross income.

Find A Lender That Offers Great Service. Compare More Than Just Rates. Web Typically lenders cap the mortgage at 28 percent of your monthly income.

Ad Are you eligible for low down payment. Lock Your Rate Today. Get Instantly Matched With Your Ideal Mortgage Lender.

Web Web So if you paid monthly and your monthly mortgage payment was 1000 then for a year you would make 12 payments of 1000 each for a total of 12000. Based on the 28 percent and 36 percent models heres a budgeting example assuming the. Web Once a potential home buyer has taken the time to examine their personal finances and established how much house they can afford by using the 2836 ratio.

Were not including additional liabilities in estimating the. Ideal debt-to-income ratio for a mortgage For conventional loans. Compare More Than Just Rates.

Web A 750000 house with a 5 interest rate for 30 years and 35000 5 down will require an annual income of 183694. Web This rule says you shouldnt spend more than 35 of your pre-tax income or 45 of your after-tax income on your total monthly debt which includes your mortgage. Comparisons Trusted by 55000000.

Web Your proposed housing payment then could be somewhere between 26 and 35 of your income or 1820 to 2450. Explore Top Rated Information. Trusted VA Home Loan Lender of 300000 Military Homebuyers.

Ad Are you eligible for low down payment. The principal interest taxes and insurance or PITI. Web Based on your monthly income of 6000 your back-end ratio would be about 44 percent.

Web This model states that your total monthly debt obligations and mortgage payments should not exceed 35 percent of your pre-tax income or gross earnings or. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. To determine your front-end ratio multiply your annual income by 028 then divide that total by 12 for.

Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Ad More Veterans Than Ever are Buying with 0 Down.

If your home is highly energy-efficient and you. Or 45 or less of your after-tax net income. Lock In Your Rate With Award-Winning Quicken Loans.

Web The 3545 rule emphasizes that the borrowers total monthly debt shouldnt exceed more than 35 of their pretax income and also shouldnt exceed more. 2 To calculate your maximum monthly debt based on this ratio multiply your. Web For FHA loans its generally 43 percent but also can go higher.

Ad Compare Home Financing Options Online Get Quotes. Your total monthly inescapable obligations including PITI should be 35 or less of your pre-tax gross income. Calculate How Much You Can Borrow - Determine How Much House You Can Afford Now.

Estimate Your Monthly Payment Today. The 35 45 model. To follow this rule your monthly mortgage payment should be 28 or less of your gross monthly income.

Web Percent of income to taxes About This Answer. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

Choosing Mortgage Terms In 2023 Wealthrocket

35 Costly Medical Bankruptcy Statistics Etactics

Mortgage Loan Wikipedia

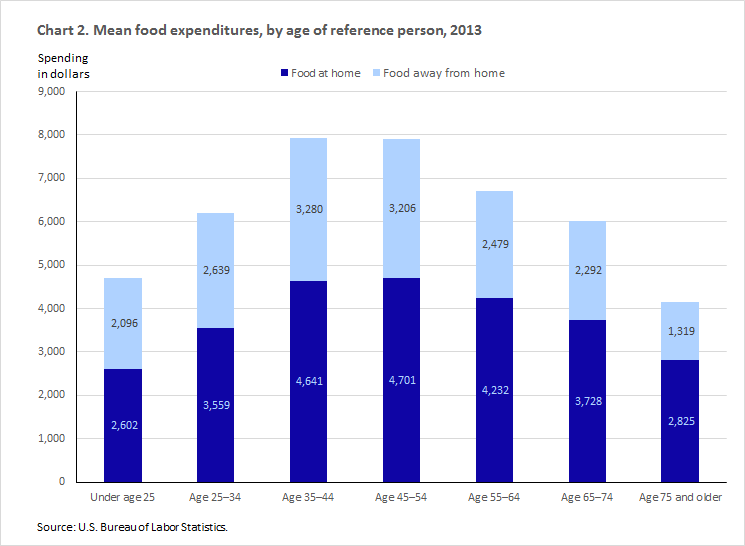

Consumer Expenditures Vary By Age Beyond The Numbers U S Bureau Of Labor Statistics

What Percentage Of Your Income To Spend On A Mortgage

Mortgage Loan Wikipedia

What Percentage Of Income Should Go To A Mortgage Bankrate

What Percentage Of Income Should Go To Mortgage Banks Com

The Difference In Retirement Savings If You Start At 25 Vs 35

The Middle Class Crunch A Look At 4 Family Budgets The New York Times

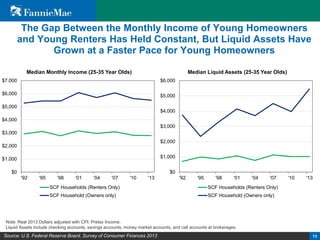

Mark Palim Genyhousing 6 4 15

Active Fixed Income Perspectives Q1 2023 From Pain To Gain

Mortgage Repayments As A Percentage Of Income Download Scientific Diagram

What Percentage Of My Income Should Go To Mortgage Forbes Advisor

Solved Exhibit 9 8 Housing Affordability And Mortgage Chegg Com

Fha Loan Calculator Check Your Fha Mortgage Payment

Bond Market A Tad Antsy About Inflation Not Just Vanishing One Year Yield Nears 5 Mortgage Rates Back At 6 5 Wolf Street